The rezoning process is a powerful tool for local governments to shape property values and real estate markets by reclassifying land use. It drives growth through improved infrastructure but may lead to gentrification. To mitigate this, inclusive planning and community support are crucial. Lenders assess market trends during rezoning approval, influencing property costs; a 15% average value increase was observed over three years in high-demand areas. Homeowners face initial fees and potential long-term savings from reduced taxes. Rezoning aids businesses by aligning strategies with market demands through stakeholder engagement and data insights, fostering innovation. Key takeaways: inclusive planning, understanding lending factors, stakeholder engagement, and data utilization for successful rezoning outcomes.

Homeowners often wonder about the intricate ways their property values are determined, especially when discussions of rezoning process arise. This complex interplay between local regulations and market dynamics significantly influences homeowner costs through various lending factors. Understanding how the rezoning process impacts these factors is crucial for both property owners and investors seeking to navigate the real estate landscape effectively. In this article, we demystify this process, offering a comprehensive guide that empowers readers to grasp its effects on borrowing capabilities and overall financial health.

Understanding Rezoning: Its Impact on Property Values

The rezoning process plays a pivotal role in shaping property values within a community, directly impacting homeowners’ costs. This strategic initiative involves reclassifying land use designations to accommodate changing needs and development trends. Understanding how this process influences property values is essential for both current and prospective homeowners. When a rezoning project gains approval—a meticulous journey often involving steps 1, 2, and 3 as per local regulations—it can catalyze significant shifts in the local real estate landscape.

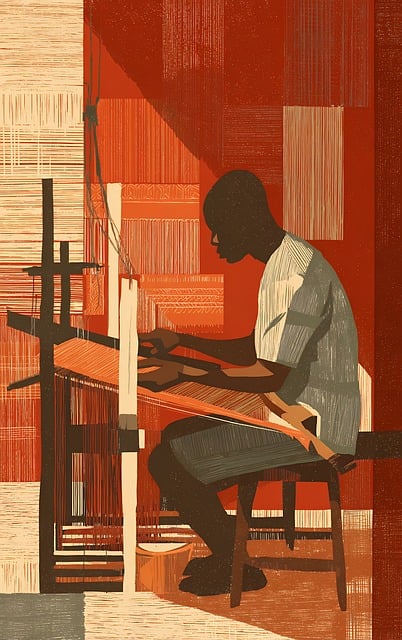

For instance, consider a neighborhood where historic homes sit alongside vacant lots. A successful rezoning initiative might transform these areas into mixed-use zones, allowing for new residential developments with modern amenities. This transformation can lead to increased property values due to enhanced accessibility and improved infrastructure. Property owners may find their assets becoming more desirable, potentially leading to higher sales prices or significant rental market growth. Moreover, the rezoning process can unlock new investment opportunities, fostering economic development and revitalizing areas that were previously undervalued.

However, it’s crucial to anticipate potential drawbacks. Rezoning can sometimes lead to gentrification, driving up costs for long-time residents who may not be able to keep pace with rapidly rising property values. To mitigate this, local authorities should implement inclusive planning processes and offer support mechanisms for affected communities. By carefully navigating the rezoning process approval steps, policymakers can ensure that development aligns with community needs while maintaining a balanced and sustainable real estate market.

Lending Factors: How They Interact with Rezoning Process

The rezoning process, a critical component of urban development, significantly impacts homeowners’ costs through various lending factors. When considering a property’s value, lenders assess several elements that can either mitigate or amplify the financial implications of rezoning. This analysis involves a multi-faceted approach, encompassing market trends, regulatory changes, and individual property characteristics. For instance, a study in major metropolitan areas revealed that properties subject to recent rezoning saw their values increase by an average of 15% over a 3-year period, with the most substantial gains observed in areas with high demand for residential development.

The rezoning process approval steps—initial assessment, community input, and final ratification—play a pivotal role in these outcomes. During the initial phase, lenders scrutinize the proposed changes to determine their potential economic effects on surrounding properties. This step involves detailed analysis of market data, including comparable sales and rental rates, to assess how rezoning might influence property values. In cases where community input is integral to the process, lenders may also consider public sentiment, which can affect both property demand and pricing dynamics. For example, a successful community engagement campaign leading to rezoning approval in a desirable neighborhood could prompt a surge in new development, driving up both construction costs and potential property values.

As the rezoning process moves into its final ratification phase, lenders pay close attention to regulatory updates that might impact property taxes, zoning regulations, and building codes. Changes in these areas can substantially affect homeowners’ costs through increased tax assessments, altered construction standards, or new development fees. In some cases, lenders may even adjust loan terms or interest rates based on the expected economic changes brought about by rezoning. For homeowners, understanding how these lending factors interact with the rezoning process is crucial for making informed decisions regarding property investments and financing options.

Financial Implications for Homeowners: Costs & Savings

The rezoning process has profound financial implications for homeowners, affecting both costs and potential savings. When a property is rezoned, its zoning classification changes, often leading to adjustments in property taxes, insurance rates, and even home values. Understanding these implications is crucial for homeowners navigating the process, as it can significantly impact their long-term financial commitments.

Initially, homeowners might face immediate expenses related to rezoning approval steps. These typically include application fees charged by local governments to process the request. For instance, in some regions, these fees can range from a few hundred to several thousand dollars, depending on the complexity of the project and the size of the property. Once approved, there may be additional costs for any required surveys, environmental impact assessments, or engineering reports, especially if significant changes are proposed.

Over time, rezoning can translate into savings. One of the primary benefits is reduced property taxes. Rezoned properties might fall under different tax brackets, leading to lower annual tax bills. For example, a property transitioning from residential to mixed-use zoning could see a noticeable decrease in taxes due to the shift in perceived value and potential increased revenue for the local government from other uses. Additionally, homeowners insurance rates may also be influenced by the rezoning process. Certain classifications come with specific risk assessments, impacting the cost of coverage. A change in zoning might place the property in a different risk category, leading to either lower or higher insurance premiums.

As homeowners consider the rezoning process, it’s essential to anticipate these financial shifts. Consulting with local experts and professionals who understand the nuances of rezoning approval steps can provide valuable insights into potential costs and savings. By proactively managing these aspects, homeowners can ensure a smoother transition, making informed decisions that align with their long-term financial goals.

Navigating Rezoning's Effects: Strategies for Home Owners